The world is on the verge of a critical minerals shortage. And it’s driving what we anticipate being a renewed Aussie mining boom.

Mining insider James Cooper reveals his attack plan for capitalising on this trend.

Get James Cooper’s ‘Age of Scarcity Attack Plan’ video briefing

(and full transcript) straight to your email inbox.

You’ll get it when you subscribe to the FREE daily investment email, Fat Tail Daily. Simply enter your email address in the box below and click ‘Subscribe Now’.

Take a FREE subscription to Fat Tail Daily to watch this urgent video briefing. In it, you’ll hear about:

- The Aussie mining company that could hold the tech industry’s future in its hands. This ASX company is set to make Australia the second-largest global supplier of a mineral that’s critical for manufacturing every electronic device you can think of. It’s a long-term growth play that you could buy into for less than $1 (at the time of writing).

- How to dominate key critical minerals spaces with a single stock play. It involves a $400 million ‘Pilbara dominator’ firm sitting on rich deposits of copper, zinc, and silver — key elements for the world’s decarbonisation efforts.

- This 29-cent stock could be the world’s second-largest graphite supplier. It owns a massive 144,000-tonne-per-year graphite mine with a staggering 40-year mine life. That could make it a major player in the EV battery minerals space. And at just 29 cents a share (at the time of writing), it’s cheap to get in!

- A must-own standout in the gold sector. This junior gold producer only shed a mere 5%, even as its peers got hammered during the gold market sell-off — thanks to its maiden profit after tax of $89.5 million. And it could soar even higher as it’s set to open a second mining operation.

Dear Reader,

Rising inflation rates and stock market dips may dominate the daily newsreel…

In our view, those are just smokescreens that hide the real problem the world is facing…

An upcoming ‘age of scarcity’.

We are about to face a severe supply crunch on every commodity imaginable, from iron ore to rare earth metals.

And almost every country and supply chain in the world will be affected.

One insider predicts it will be ‘the biggest commodity supply squeeze ever in history’.

Even French President Emmanuel Macron says that ‘we are living the end of what could have seemed an era of abundance’.

All of this is happening because of chronic underinvestment in critical resources like metals, oil, and gas in the past decade.

That means we’re not replacing the reserves we currently have — and they’re quickly running out.

But the age of scarcity is also a huge opportunity for a handful of Australian miners to solve the crisis.

As a result…

Aussie mining is set to boom again

The Sydney Morning Herald predicts that ‘the years ahead will be like the mining boom on steroids’.

And if you look at mining stocks right now, you’ll notice that some are starting to climb higher…as the wider market is plummeting.

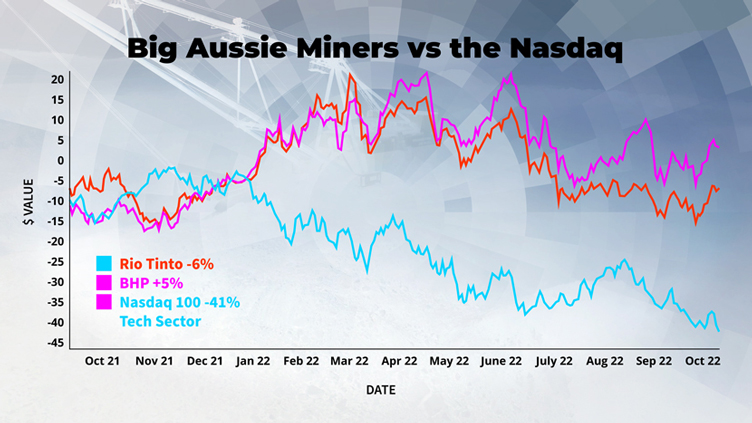

Just look at two of the biggest players in Aussie mining — Rio Tinto [ASX:RIO] and BHP Group [ASX:BHP] — compared to the tech sector:

Source: ProRealTime

Past performance is not a reliable guide to future results.

The smart money has already begun to move on this trend.

Major Wall Street banks, from Goldman Sachs to JPMorgan, have been quietly putting their high-net-worth clients back into real assets and resource stocks.

That’s why we believe…

You should make your move, too

Here’s our prediction:

This scarcity trend will become one of the ONLY games in town when it comes to making exponential gains over the next 10 years.

If you want the opportunity to capitalise…

You should be buying cheap but valuable resource stocks that could become MUCH more expensive as this anticipated age of scarcity plays out.

But with dozens of new and established mining stocks on the ASX, how do you even begin to pick the right ones?

This is where James Cooper comes in

James Cooper is an experienced geologist and mining insider who’s worked for the who’s who of Australian mining…from small outfits to major players like Dacian Gold [ASX:DCN] and Northern Star Resources [ASX:NST].

He’s seen it all — from massive ore discoveries to multibillion-dollar takeovers…and crushing failures in between.

James was even at the heart of it when Barrick Gold bought out Equinox for $7.5 billion.

Which makes him the perfect person to guide you through the anticipated age of scarcity — and show you how to profit from it.

You’ll read about his findings in his ‘Age of Scarcity Attack Plan’ video briefing.

In it, he discusses the five core stocks that are trying to corner the key resource sectors for the new age of scarcity.

Investing in small mining stocks is risky, but James believes each of them has the potential to outperform the wider market significantly in the coming years.

And there’s one stock in particular that he sees holding massive potential.

He calls it…The ‘Son of Fortescue’

It’s a relatively unknown company with the same vision and grand plan as Fortesque’s founder Andrew Forrest…gunning for dominance in a billion-dollar space that will become ground zero in the coming age of scarcity.

Learn about the ‘Son of Fortescue’ — and four other mining stocks James is recommending — in his video briefing, ‘The Age of Scarcity Attack Plan’.

To watch it right now, enter your email address in the box below and click ‘Subscribe Now’. You’ll get a link to the video delivered to your inbox within the next five minutes.

Get James Cooper’s ‘Age of Scarcity Attack Plan’ video briefing

(and full transcript) straight to your email inbox.

You’ll get it when you subscribe to the FREE daily investment email, Fat Tail Daily. Simply enter your email address in the box below and click ‘Subscribe Now’.

You can watch ‘The Age of Scarcity Attack Plan’ video briefing right now when you take a FREE subscription to Fat Tail Daily, Australia’s leading source of independent investment ideas.

This isn’t just speculation from a ‘hobby pundit’

James has been right in the thick of it — from exploring the Australian outback to looking for copper in the jungles of Zambia.

He knows how to dig into actual dirt just as well as balance sheets.

And that gave him first-hand evidence of how this age of scarcity will play out in the coming years…

…and if he’s right, how you can benefit from this megatrend.

Start by taking out a FREE subscription to Fat Tail Daily by entering your email address in the box below and clicking ‘Subscribe Now’.

Get James Cooper’s ‘Age of Scarcity Attack Plan’ video briefing

(and full transcript) straight to your email inbox.

You’ll get it when you subscribe to the FREE daily investment email, Fat Tail Daily. Simply enter your email address in the box below and click ‘Subscribe Now’.